S&P 500; DJI; NASDAQ All Continue Record Highs

The stock market opened strongly on Monday morning. July has been a strong month for the stock market, as investors remain bullish on the U.S. economy. 2025 has been turbulent, no doubt, but the market seems to be settling.

Digging Out

The no-good, very bad, pretty awful performance that was the stock market in late March and early April feels long gone at this time. The S&P dipped below $5,000, the lowest in over a year.

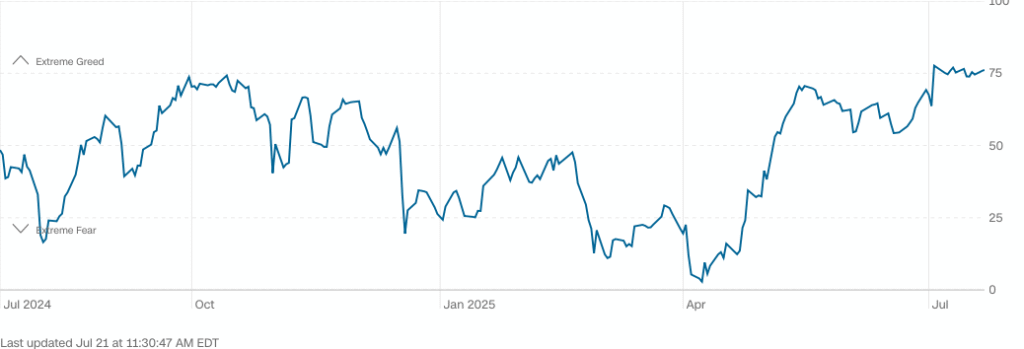

After confidence levels hit lows in April, the market has had a quick recovery. Tariffs remained a concern for many, but as the U.S. and President Trump seemed to settle a few trade deals, the market brought back its confidence.

Mid-February of 2025 saw record highs in the stock market, before a few bad weeks. It wasn’t until June 26th that we saw the stock market continue to move past record highs again.

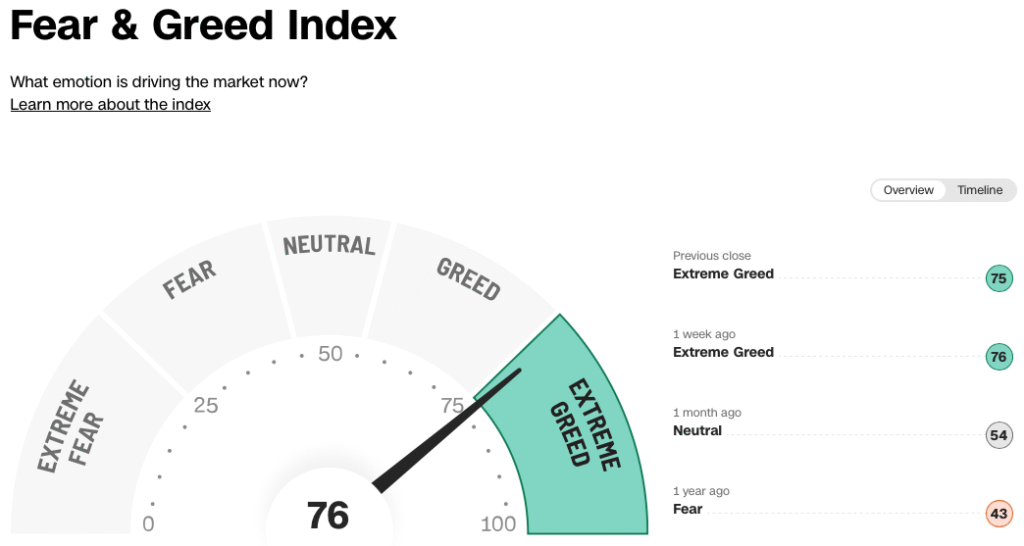

April saw consumers and the market driven by extreme fear, hitting as low as 3. Today, the index sits at 76, the highest in a year.

The Fear & Greed Index strongly reflects the performance of the stock market

The economy has had a strong-but-unsteady few months. Job rates continue to be strong, with unemployment sitting at 4.1%, while inflation has cooled from 2024. However, tariffs continue to give economists and consumers pause. Inflation ticked up in June to 0.3%, after four great months. GDP in Q1 saw negative growth, mostly due to heavy imports from businesses fearing extra costs due to tariffs.

Right now, things look good for the stock market and the U.S. economy, there is still reason to be cautious. A strong investing policy includes restraint, but investing early is better than waiting to time the market

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.