The United States has had an odd trajectory over the last few years. But where are we now, and what does the future hold?

June 2022 – The U.S. hit inflation levels it hadn’t seen since 1981. Inflation was peaking at 9.1%, and U.S. consumers were feeling the pain of prices. Gas prices hit record highs, while food essentials like eggs, wheat, and milk were all reaching record highs.

Interest rates were near their floor as the Federal Reserve was attempting to keep the economy moving post-COVID. But due to skyrocketing inflation rates, the Federal Reserve bumped up the interest rates from 0.25% to 0.5% on March 16. They continuned to move up interest rates through all of 2023 as the Fed attempted to battle historically high prices. The final interest hike was in July 2023, where rates stayed at 5.5% for over one year.

Since then, prices have started to drop, making their first improvements in 2024, followed by some relief from the Federal Reserve.

2024 – Recovery

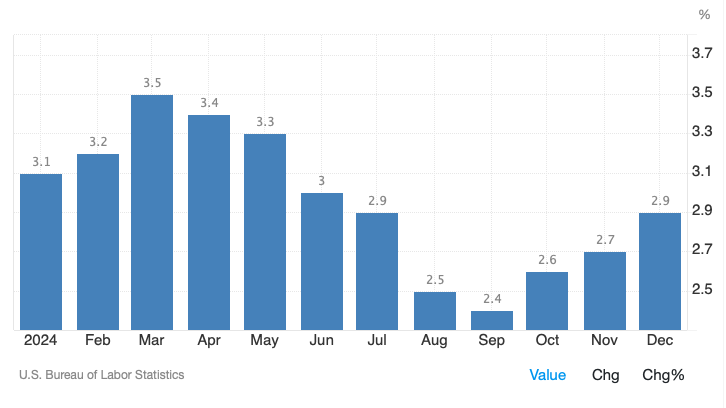

After prices peaked in 2022, we saw slow recovery. However, 2024 finally saw much needed progress in prices that US consumers needed. In January, inflation rates were down to 3.1% before spiking up to 3.5% in March. Fortunately, since March, we haven’t seen inflation above 3.5%. September 2024 saw the best month in years, with inflation hitting 2.4%. Prices in gasoline were finally starting to drop, and food prices were sitting at comfortable lows.

Unfortunately, October saw the rise of avian flu, which saw prices surged, especially for eggs. Inflation would end at 2.9% in 2024. Fortunately, in 2025, price relief would come.

2025 – Relief & Caution

After inflation bumped up in January, April would see the lowest inflation rate since February 2021. After four years, relief was finally here. Egg prices had been plaguing U.S. consumers, but prices fell in late March and early April. March was the first time in a long time that prices actually dropped, as the seasonal adjusted rate was -0.1% for the month.

But while prices have been falling, economic policy has been a major discussion for many. Tariffs remain a major topic for investors and the Federal Reserve. Fed Chair Jerome Powell stated that there the economy is strong, and prices are low, but fear of inflation due to tariffs remain a factor for lowering interest rates.

Today, the job market is strong, inflation is the lowest its been in years, and economic policy continues to be a major roadblock on understanding recovery. President Trump has made several deals to date on tariffs, but many still fear that major tariffs could lead to a spike in inflation. It seems that if inflation holds steady or drops, we many see some more relief in interest rates.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.