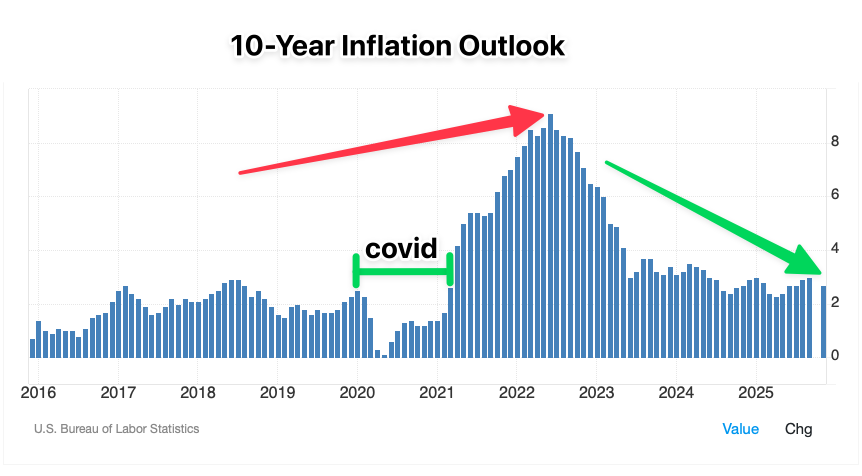

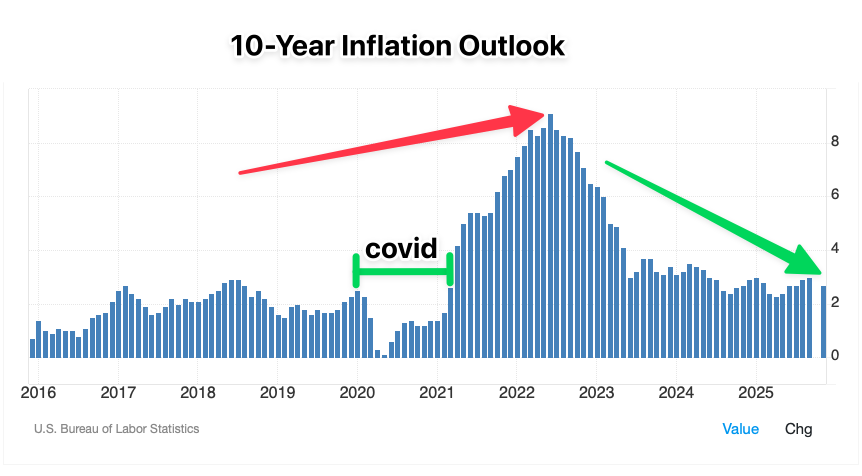

Overall, prices are stabilizing since the fiscal fiasco that was 2021-2023. Inflation reached highs of up to 9.1% in June 2022, and consumers have been paying the price ever since. Let’s examine the current price and inflation situation, and evaluate products with stable prices, those with low prices, and those with high prices.

Products That Are Stabilizing (coming down, but still high)

This category is a list of products and services that have started to stabilize in price, meaning that the prices spiked in 2022 and are finally coming down. However, this does not mean that they are cheaper than they were before COVID, as the prices are either stabilizing at a new equilibrium or are still on the way down from their high prices from the last couple of years. This is important to understand because prices sometimes go up for products and never come down, while some prices, like groceries or gasoline, fluctuate, and after a heavy period of inflation like the one we had recently, it is still impacting our budgets.

*Note, some prices are measured at cost from manufacturer–>Distributor (not cost to consumer). Some costs have odd measurements (e.g. Orange juice is cents/pound). For best understanding, compare overall prices.

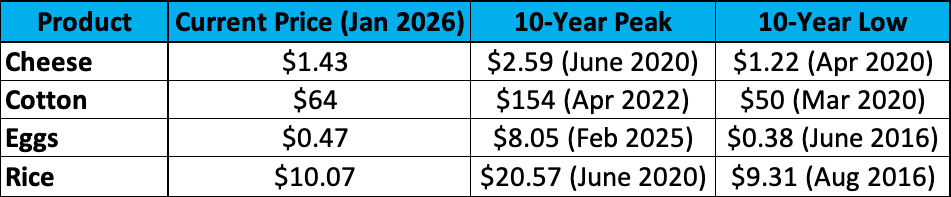

Products With Low Prices

These products are well below their 10-year average and are well stabilized. They may not have been priced below their all-time low, as the lingering effects of inflation are long-lasting, but they are at a good price for distributors, and hopefully consumers.

Note the massive change in prices in eggs, as consumers were regularly play $8-10/dozen just a year ago.

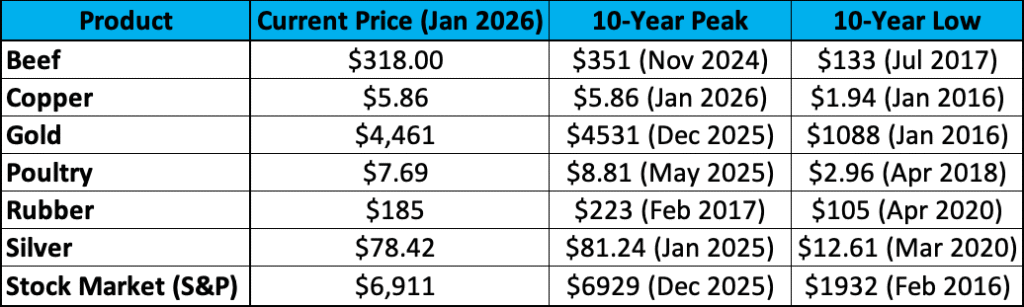

Products With High Prices

This category are the products that have high prices today, well above their 10-year average. They may not be priced above their 10-year peak, but they are still high, and there are not necessarily good signs of the prices coming down.

Some listed here are not bad to have high prices, such as the stock market and gold and silver.

What You Can Do About It All

Overall, much of this news is encouraging. Prices and inflation are coming down. However, as we can see by the numbers above, only a few products are actually lower than their average; most are above, just stabilizing. This means that you should expect to pay more than you did 10 years ago, as you should always. Unforatunely the high peaks of prices in 2021-2023 really hurt the economy in the long-run. However, strong relief starting in 2024, has helped consumers find some relief.

When building your budget (you can find one here if you need a good, free starter budget), it’s best to factor in a minimum of 2-3% increase in your expenses each year. There is positive news from the Bureau of Labor Statistics, indicating that wages are increasing. However, unemployment data has been less positive, trending in a negative direction for employees and layoffs.

Right now, the best option is to view the economy as moving in the right direction, but still volatile. It is best to save where you can and try to stick with your current job, as finding new jobs is difficult right now. Wages are increasing steadily, keeping pace with inflation, but consumer spending is also rising. Ensure that you have strong habits and are building a healthy financial lifestyle to battle the somewhat volatile market.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.