Price Updates – Economy Outlook

Prices have been up and down over the last few years but seem to be settling lately. Let’s review a few of the prices that are making an impact on the state of our economy.

Egg Prices

Going into 2025, egg prices were a major discussion point for many. Major issues with supply due to avian flu outbreaks spiked the prices in late 2024 and the first few months in 2025.

Egg prices According to Trading Economics spiked in early 2025 due to avian flu outbreak

The USDA announced a plan in late February to fight avian flu and invest $1 billion to fix the issue. Within a few weeks, American consumers saw much-needed relief. September has seen even lower prices, while the current avian flu issues seem past us.

Gas Prices

Gas/energy prices are notoriously erratic, as can be seen by the prices over the last year. Major spikes in 2022 gave Americans and many around the world a major hit on filling up their gas tanks, but since then we’ve seen some relief.

Gas prices according to Trading Economics saw major spikes in 2022

Since late 2024, gas prices have been settling quite well, with consumers paying on average around $3.193/gallon according to AAA. Prices a year ago were not too much higher, around $3.27/gallon.

So far through 2025, gas prices have been consistent, though we’ve seen a spike followed by a quick drop after the short conflict in Iran.

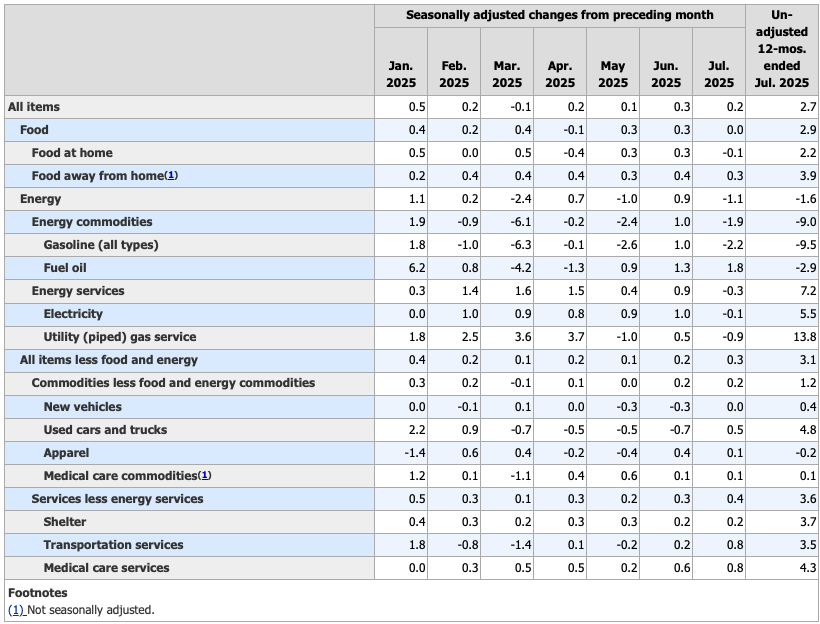

Inflation

As we wait for the latest updated CPI numbers, the un-adjusted 12-month inflation rate was 2.7%. July had a 0.2% inflation increase, following a 0.3% in June and a 0.1% in May. Fluctuations in gasoline, energy, and food prices have caused this number to swing, and while there was some relief earlier in the year, the inflation rate still offers hope for improvement-though caution remains necessary.

Many are speculating a rate cut by the Federal Reserve next week as job numbers have suffered in recent reports. However, the inflation rate at 2.7% is causing concern for some, as lowering the interest rates will likely see growth in economic activity and demand, which inherently raises prices.

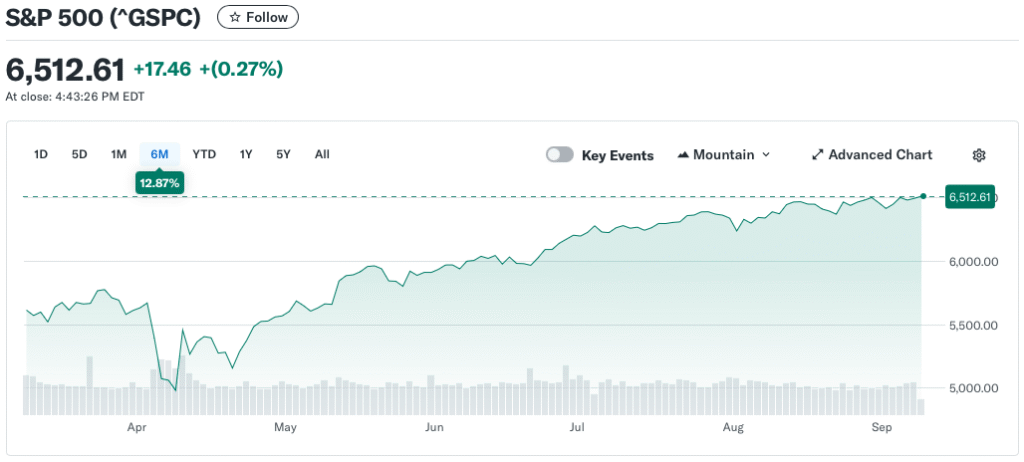

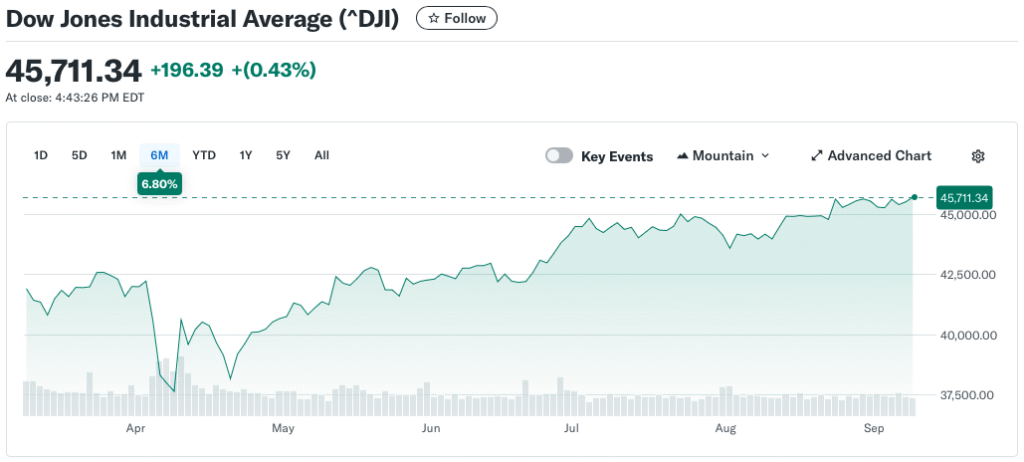

Stock Market Prices

We’re a few months past the forgotten dip of April, and the stock market is thriving. While there has been some caution about job reports and the Fed’s lack of movement on interest rates, the market continues to trade at record highs.

The S&P 500 and Dow Jones are both trading at or above record highs, and have seen several strong weeks for investors. The S&P is up around 12.87% over the last months, and the DJI is up around 6.8%. These are strong numbers, as they far exceed the average growth annual rate of 8-10%.

Hope & Caution

Prices are trending in the right direction, though the U.S. economy still has some work to do. A concerning report regarding job growth in 2024-March of 2025 showed that job growth was over counted by 911,000. And while inflation is far below the rates of 2022, we still have some room for steady decline.

The stock market is strong, trading at highs, and price increases are slowing. However, the labor market is still somewhat unstable. The Fed’s chance of reducing interest rates is spiking, especially after two uneven job reports.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.