April was a bad month for investors and stock traders. After several strong weeks of trading, the market saw back-to-back poor performing weeks in March, followed by a massive dip on April 2-4th. Gains made earlier in the year were wiped out almost instantly, and many feared that this was leading to a recession. However, since then, the market has been looking a lot stronger with several weeks of steady recovery. So, is the stock market back?

April’s Performance

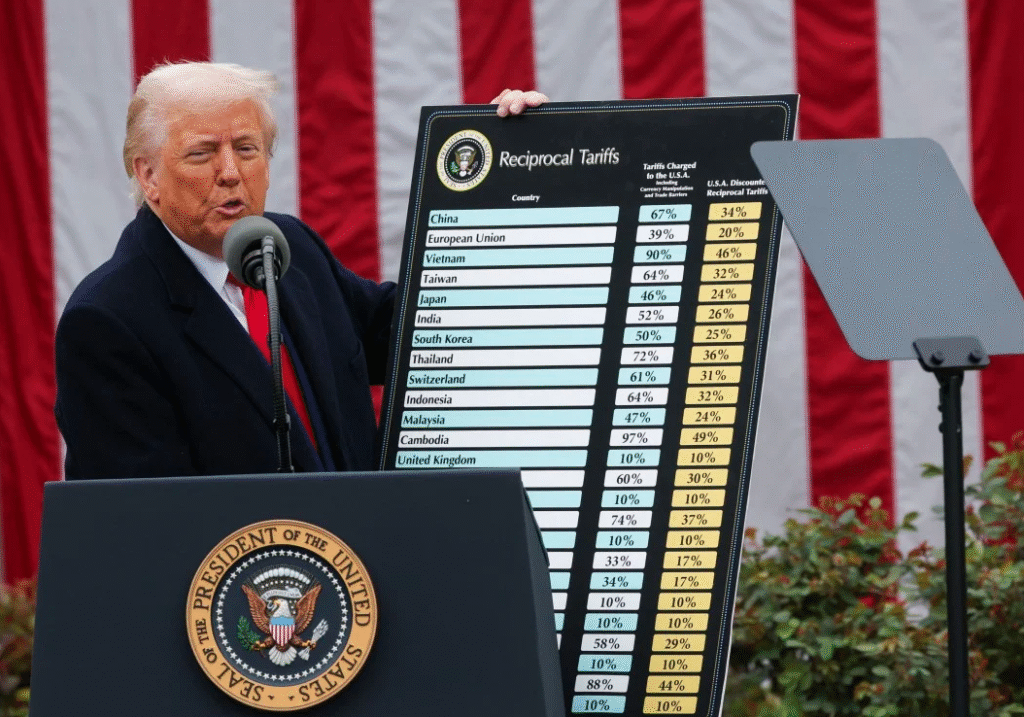

On April 2nd President Trump announced “Liberation Day,” which ultimately meant massive tariffs and reciprocal tariffs. The stock market had already been struggling with tariffs and trade talks over the preceeding weeks, but April 2nd brought everything to a head. On April 2nd, the S&P closed around $5,670, slightly up over the preceeding two days. However, on April 3rd, the market opened at $5,492 and closed at $5,396. This was a huge drop of 4.8%, but the worst was yet to come. On April 4th, the market opened at $5,292 and closed at $5,074. This was more than a 10.5% drop in the stock market in just two days. The market bottomed out around $4,953 the next day, leading to a total loss of over 12.5%.

The Road to Recovery

Coming back from a 12.5% drop in the market was going to be a hard task. Unfortunately, a few good days of market performance would not be enough, the market would need to string several weeks of strong performance together to see a rebound.

Understanding that math here can be helpful, so let’s review how the market would need more than a 12.5% increase to rebound.

100-10% = 90

90+10% = 99

Let’s break that down to the stock market, and see where we would need to go to have full recovery.

5670-12.5% =4,961.25

4961.25+12.5% =5,581.406

This means that the market would have to perform over 12.5% better than to fully recover. As we know the stock market has days of ups and downs, so the recovery was going to be long.

Where Are We Now?

As of June 9th, the S&P 500 closed at $6,005.88. This is an increase of 21% since April 4th. The market is also up almost 6% since April 2nd, before the impacts of the trade talks made their way to the stock market. On February 19, the S&P 500 hit an all time high of $6,144. While we haven’t reached that high yet, we are on a strong pace to get back there, likely by the end of the year if not earlier.

What Have We Learned?

While many were afraid of a recession or a stock market crash, it’s important to remember to remain calm when investing in the stock market. There will be days of losses, and even weeks or months of losses. However, a few bad weeks on the market is nothing to be afraid of. Anyone who sold during early April likely lost thousands of dollars. The stock market is a long-term tool for builidng investments for retirement. Most are unsucessful with short-term trading, and a bad month like April proves why.

The stock market has strongly outperformed where it was before the two-day mini crash. While traders clearly do not like discussion about limited trade and tariffs, trade deals and a focus on other economic policy have proven to be positive. The market is back, and stronger than it was in March and April and is not far off from hitting record highs once again.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.