The stock market has struggled the last 20 days or so and we’re seeing little relief. Meanwhile, interest rates have increased again, Bitcoin continues to fall, and tariffs continue to dominate the headlines. Let’s take a look at all of these.

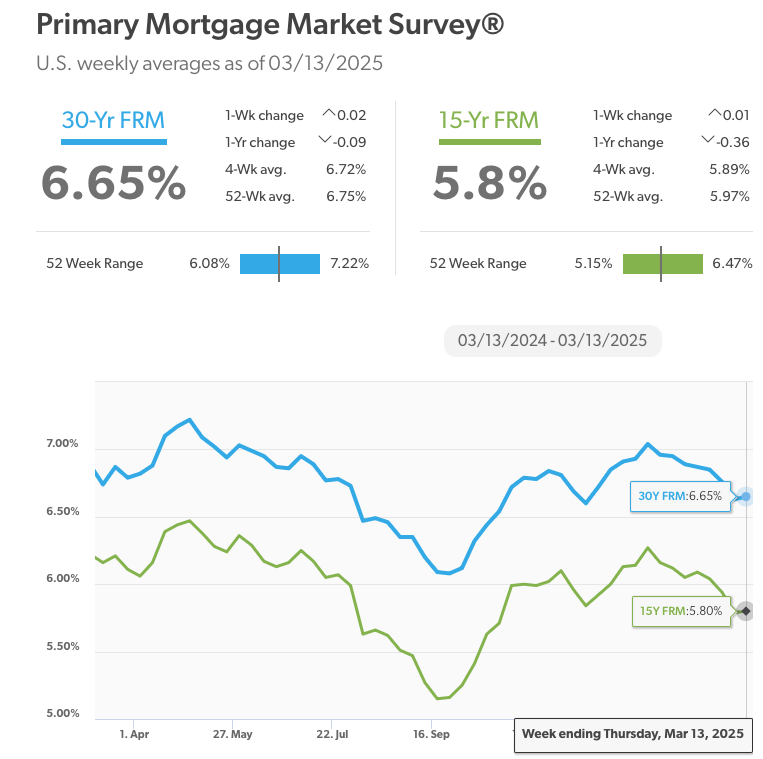

Mortgage Rates Increase 0.2%

Last week saw continued strong movement on interest rates as they dropped to 6.3% for 30-year mortgages. This week, we saw interest rates bump up 0.2% to 6.65%, slowing the postive growth we’d see for the last few weeks.

FreddieMac’s analysis of this week’s movement stated, “Despite volatility in the markets, the 30-year fixed-rate mortgage remained essentially flat from last week. Mortgage rates continue to be relatively low versus the last few months, and homebuyers have responded. Purchase applications are up 5% as compared to a year ago. The combination of modestly lower mortgage rates and improving inventory is a positive sign for homebuyers in this critical spring homebuying season.”

U.S. consumers are quickly responding to the lower rates, as higher rates have been a difficult part of the puzzle for those looking to own homes. The higher demand has quickly led to new home purchases, immediately jumping interest rates. We will wait to see a new trend.

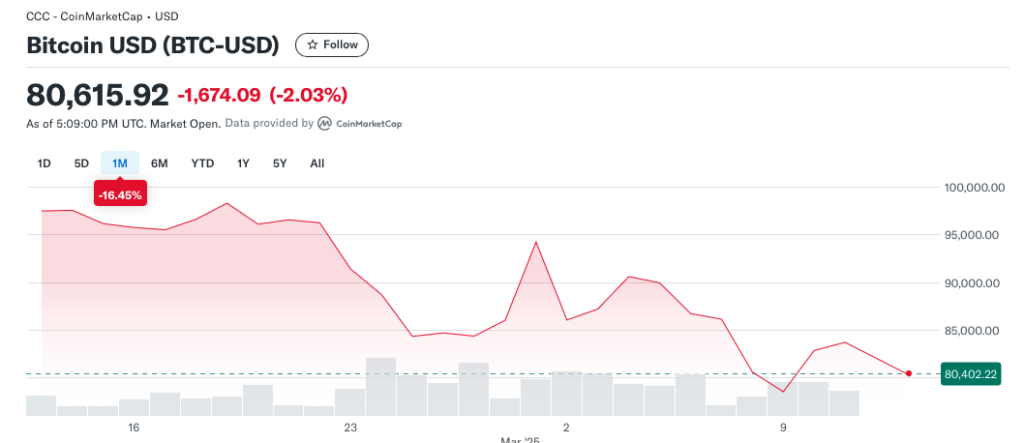

Bitcoin Drops

The still-highly volatile cryptocurrency remains in a bit of a downturn. Currently trading at $80,615 as of March 13, Bitcoin is down 16.45% over the last month. The biggest drop off came after February 22nd when it was trading around $96.2k, and on the 25th, it dropped to $82.1k.

This dropoff matches the timeline of the dropoff of the stock market, as consumer sentiment seems to be weak. However, Bitcoin is not an American only owned product, and while the drop off could be tied to the U.S. markets, it’s unlikely that the insecurity has led to a fall-off. Because profits or a physical product do not drive Bitcoin, investor demand plays a major role in the investment price. If many people start to sell off, whether for uncertainty or to cash in gains, then the demand for Bitcoin will drop, leading to price drops. It’s possible that uncertainty in the global market, due to President Trump’s tariff threats, has caused uncertainty in the cryptocurrency, but it is hard to close in on certainty to the price drop. We have seen some resistance around $79k, so those looking to invest may keep their eyes open to that price, and if feeling lucky, throw some cash at the cryptocurrency.

Personal Finance During Uncertain Times

Ultimately, Freedom Finances is all about personal finances and giving guidance for those looking for a path to better financial security and freedom. So what should you do when the stock market is down, interest rates are up, and unemployment is uncertain? Much of the answers do not change when there is economic uncertainty. First and foremost, everyone should have a budget. If you don’t know how much of your money is coming in and going out, it is hard to be successful. If debt is an issue for you, we have a debt calculator to help you get control of your accounts and build a plan to start paying off your debt. Check out our financial resources here for more tools and resources to help you build your financial future.

In the meantime, headlines are meant to give you an emotional response to read the organization’s work. Tariffs can be confusing and the discourse can be irritating, but as any other economic policy by the government, personal finances is something that should be looked at and controlled in the home with family members only. Don’t focus on the news, but instead focus on your income, your expenditures, and your debt, and find your way to financial freedom.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.