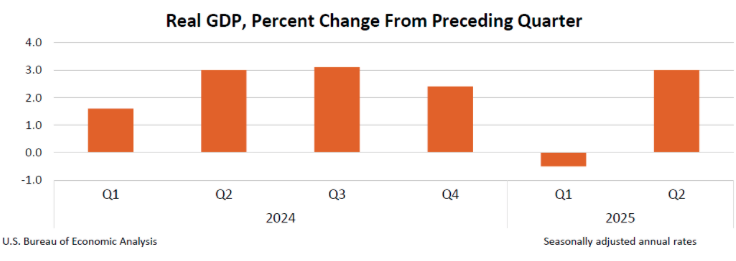

The Gross Domestic Product Q2 report was released today to good news along with the Federal Reserve’s decision on interest rates.

GDP Results

After the GDP retracted in the first quarter of 2024, Q2 saw a 3.0% growth. The biggest increase came from a decrease in imports, which is part of the calculation to increase overall GDP. Q1 saw a massive increase in imports from businesses who feared tariffs, causing the GDP to detract. Since then, movement in trade has slowed, cause the massive swing.

The Federal Reserve Holds Interest Rates Steady

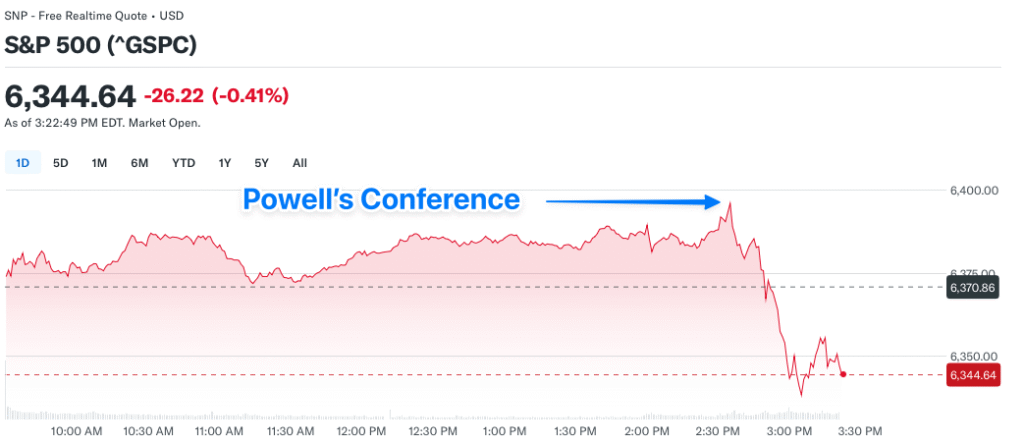

The Federal Reserve released its FOMC statement today, followed by a formal conference from Chair Jerome Powell. Interest rates will remain at 4.25-4.5% for the federal funds rate, as the Fed continues to emphasize that “the unemployment rate remains low, and the labor market remains solid. Inflation remains somewhat elevated.”

This is very similar to previous statements from the FOMC team, as tariffs continue to be a topic of conversation. However, the Committee seems to be splitting, as two individuals looked ready to lower rates. Impacts on tariffs are not what originally expected, as a one-time increase might be in the long-term outlook. Chair Powell stated that right now, most companies are covering the costs of tariffs, while consumers might start to see the price increases shortly.

The stock market reacted negatively to the news, seeing short-term sell offs.

The next FOMC meeting is scheduled for September 16-17. We will have a lot more economic data at that point, and a more decisive answer will be looked upon for many at that time. Until then, rates will remain steady, while the economy continues to grow without the support of lower rates.