There has been a lot of discussion about the strength of the economy, and headlines have been rather divisive. A lot of discussion about the future of the economy has been based on ideological points of views, but there has not been a lot of discussion about the data behind the state of our economy. So let’s review five thoughts on the state of the current U.S. economy.

1. The Stock Market is Volatile

The S&P 500 and the DJI have been on a wild ride this year. After very steady growth to start the year, the stock market tumbled in March and April. Discussions around tariffs made traders nervous, causing a quick sell off of assets, specifically on April 3rd and 4th.

The S&P 500 is down 10.18% since January 1

The S&P closed at $5,670.97 on April 2nd, and by April 8th, the price had fallen to $4,982.77 (over -12% in losses). The Dow Jones saw similar performance, as it dropped nearly 11% in that time. This volatility scared many, and even some decided to sell off some assets during these days. Those who did, unfortunately, saw a major loss, as the stock market is slowly recovering.

Since April 8th, the prices of the S&P and DJI have recovered somewhat from April 8th. Currently, the S&P sits at $5,282.70 (+6% since April 8th) while the DJI sits at $39,142.23 (+4%). So while recovery is imminent, it will take longer to get back to the highs of the year than it did to fall to the lows. There is no major stock market crash, but there is no doubt that the stock market is volatile.

2. There’s Reason for Cautious Optimism in the Labor Market

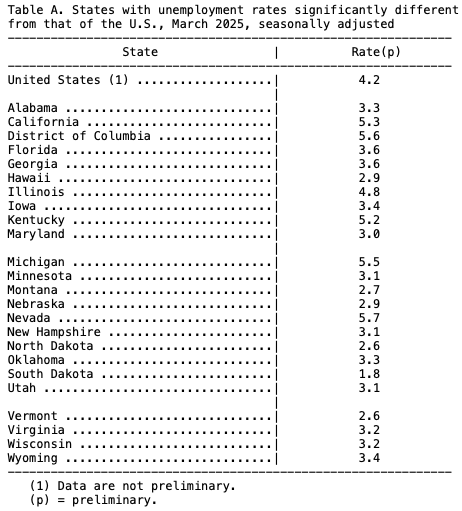

The labor market has been rather unsteady over the last few years, but seems to be recovering quite well. Yesterday, the United States Bureau of Labor Statistics released its Employment Report, showing a 4.2% unemployment rate. In the report, it was stated, “Unemployment rates were higher in March in 3 states, lower in 1 state, and stable in 46 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-eight states and the District had jobless rate increases from a year earlier, 1 state had a decrease, and 21 states had little change. The national unemployment rate changed little over the month at 4.2 percent but was 0.3 percentage point higher than in March 2024.”

On April 16th, Federal Reserve Chair Jerome Powell gave his economic outlook speech. In his speech, he stated, “Despite heightened uncertainty and downside risks, the U.S. economy is still in a solid position. The labor market is at or near maximum employment.” There is hope for the labor market in the economy, but I’d be cautious to declare we are completely in the clear. There are still plenty of questions regarding tariffs and their impacts on the economy, but the labor market today seems strong and healthy.

3. Inflation is Headed in the Right Direction*

Inflation is headed in the right direction! (*We’ll get to tariffs). There is one clear win for the economy, and that is the movement of inflation. The current Consumer Price Index (CPI) has the economy at a 2.4% inflation. This comes after a strong March report that showed prices dropped 0.1%. Much of the price decrease came from energy, specifically gasoline. Gasoline was down 6.3% and is down 9.8% over the last year.

This is particularly encouraging after egg prices led many Americans to believe that 2025 was going to be a tough year for inflation. Fortunately, the last few weeks have seen a massive drop in egg prices, dropping from a high of over $8/dozen to currently around $3.13/dozen.

There is more optimism for prices in the U.S. economy, but there is also some potential reason for concern. In Powells speech on the 16th, he stated, “As for our price-stability mandate, inflation has significantly eased from its pandemic highs of mid-2022…” He continued, “The new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation… The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

So while prices are strong, economists like Jerome Powell continue to warn of the impacts (at least short-term impacts, as he later discussed) of tariffs.

4. There is Too Much Rhetoric Around the Economy

The last few months have come with political headlines meant to sway readers towards one direction. After President Trump’s self-declared Liberation Day and the subsequent stock market fallout, many were calling for the next major U.S. recession. This rhetoric scared many people, and as they saw their portfolios turn red and lose thousands of dollars over just a few days, many felt panic.

As we will discuss in point five, there is no reason for panic. The discussion around tariffs is a difficult one to fully comprehend, and many do not fully understand tariffs and their means or impacts. (Check out our apolitical financial literacy article on Tariffs here.) It’s difficult to know what the future looks like when headlines are so politicized, especially when it comes to the economy. People want security with their wages and employment. People also want to know that their future investments are secure. Remembering a few things like the fact that the stock market historically grows around 10% on average every year, we can know that even if we have a few bad months, our investment portfolios will continue to grow.

So while headlines bring fear and worry, remember that rhetoric is not the same as data.

5. There is No Economic Crisis

This is one major fact that many continue to ignore when discussing the current economic situation in the U.S. Prices are low, employment is strong, and while trade is at best uneasy, the world economy also remains relatively strong. 2020 brought an economic crisis due to the worldwide spread of a disease. Employment was down, and people weren’t spending their money. The economy is nearly completely recovered today. In 2008, we saw a major mortgage crisis, which saw the stock market crash and leave many financial institutions permanently out of business. Today, the biggest concern is trade. What will the trade decisions of President Trump do to the markets? Well, we already know some of the potential impacts to the market, but there are potential benefits if all things go according to plan.

So, what is the current condition of the U.S. economy? Stable, growing, and volatile. We will wait for the Q1 2025 GDP report, and some indicators point towards steady but slowing growth.

Check out our video review of this topic below!

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.