A little more than a week ago, the U.S. Government was shut down, as the leaders were unable to agree on the latest budgets for the U.S. Both sides cited healthcare as an issue, but regardless of the decision and who is right, there are consequences to the government being shutdown.

Essential government workers, such as emergency workers, law enforcement, air traffic controllers, and other major workers, are still keeping the essentials moving in the economy. However, some workers, such as those in reporting for the U.S. Bureau of Labor Statistics, are not working. This leads to an information deficit, and we lose track of key statistics such as inflation rates and employment rates.

In the meantime, Americans continue to work, and the economy keeps moving. Let’s evaluate the latest information that we have, and see the state of our economy.

Stock Market

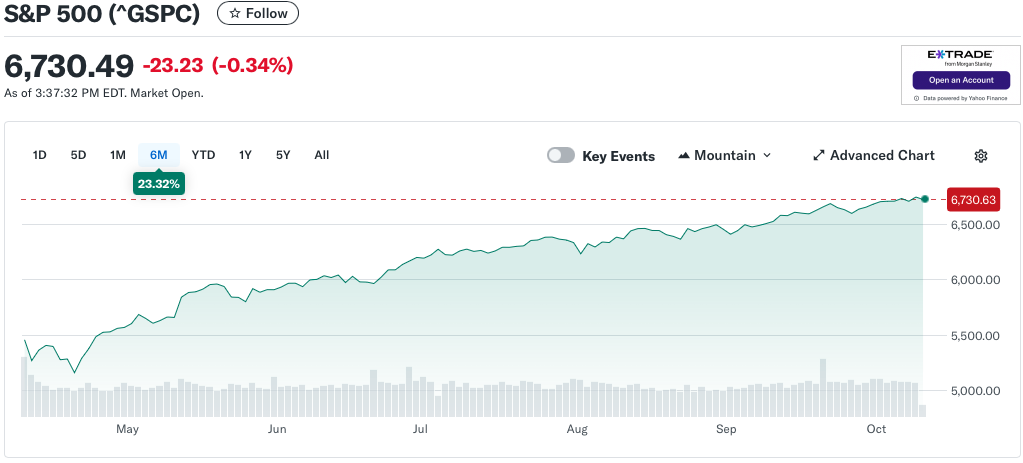

Regardless of the government shutdown, we have full access to the stock market. On October 9th, the stock market is down for the day, but the stock market has seen some strong days lately.

Over the last six months, the S&P 500 is up a staggering 23.32%. It’s important to note that some of this was an improvement from the April downturn, after the “Liberation Day” fallout. However, if we take a broader view, the S&P is still up 14.42% since January 1, which is well above average growth.

The top companies in the United States are thriving right now. We can examine the Dow Jones Industrial Average for a more rational understanding of the economy. Currently trading at around $46,350 (just below a record high), the DJI is up 9.01% over the last 1 year. That’s still above the 7.75% average that the DJI normally grows, but a less exaggerated growth rate from the S&P.

Overall, the stock market appears to be performing well, but it is not necessarily a direct reflection of the economy. It is essentially where much of our wealth is located. It is important to be invested into the stock market, but it does not necessarily reflect the strength of our income or wealth that we have access to at the moment.

Inflation

Our latest update on inflation comes from the U.S. Bureau of Labor Statistics on September 11. August’s CPI increase was 0.4%, making the unadjusted 12-month inflation rate at 2.9%, nearly 50% above the 2% goal. The latest report for September’s inflation rate would theoretically be coming out soon, but right now, due to the government shutdown, we may have delayed data.

Inflation seems to be jumping up right now, especially in August, but it’s hard to see if it will flatten soon. In August, energy took a massive jump, from -1.1% in July to 0.7%. Energy and food costs are notoriously erratic, so it’s hard to jump to any conclusions based on one poor month. We would like to see consistent movement towards 2.0% in the future.

Labor Market

Just like the inflation rates, we don’t have updated information on the labor market. On September 5, the U.S. Bureau of Labor Statistics released the employment situation summary, to a 4.3% unemployment rate. February through June saw good unemployment numbers, and there was hope that maybe the rate could dip below 4%. Unfortunately, August saw the numbers jump up, which led the Federal Reserve to act (see below).

There is still a lot of uncertainty when it comes to the labor market, but the hope is that it will settle over the next several months. CPI rates closer to 2%, and unemployment rates under 4% could see the economy at peak performance.

Mortgage Rates

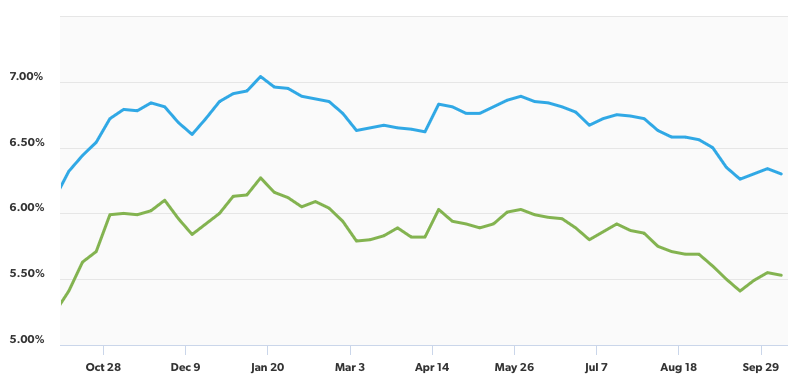

Fortunately, we have data on Mortgage Rates. FreddieMac shows the latest on mortgage rates for a 30-year loan is around 6.3%.

Mortage rates this year peaked over 7%, and have been very slowly moving down. The Federal Reserve dropping interest rates helps a little, but it does not necessarily correlate to mortgage rates. When the Fed dropped rates last year we saw rates go down, but then they ticked back up later in the year. This year, when the Fed dropped rates, they dropped again, but quickly moved back up. Hopefully some consistent movement from the Federal Reserve will give new home owners relief.