A dividend aristocrat is a company on the S&P 500 that has followed a policy of increasing dividends every year for at least 25 consecutive years. The S&P Dow Jones Index considers dividends important because dividends “play an important role in generating equity total return.”

Dividends play an important role in some investment plans, as they allow investors to see a return on their investment that is not necessarily tied to growth. This means that even if an investor were to invest in a stock that was stagnant for several years, dividends would compensate the investor for the choice of investing in the said stock. Those investing in dividends, especially dividend aristocrats allow themselves an opportunity to find growth through compound interest.

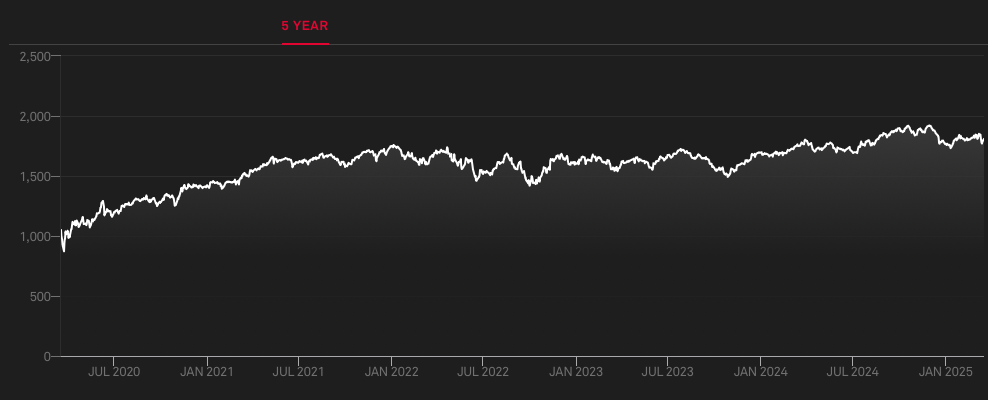

As of March 17th, 2025, dividend aristocrats have seen a one-year growth of 3.38%, with an 11.48% five-year return.

Dividend aristocrats have regular dividend returns, but slower growth than the average market

The growth of the S&P 500 over the same time frame outpaces the growth of these dividend aristocrats quite a bit. Over the same time frame, the S&P has grown 124.38%. Some may see investing in aristocrats as an odd choice when the returns on the market outweigh the returns here by more than 10-1, but dividend aristocrats are generally considered lower risk.

Investing in dividend aristocrats is a strong supplemental strategy, especially for those looking for low-risk, high-guarantee returns. While not a perfect strategy, investing in aristocrats is a good opportunity for some to diversify their portfolio while reducing risk.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.

2 thoughts on “Dividend Aristocrat”