Picking the right stock to invest in can be difficult, and even seem random at times. However, there are many ways to understand how a stock may perform in the future, even if it is impossible to predict.

Let’s practice making some stock choices. We will start with two stocks; you pick without knowing the name of the company or the stock. We will give you details regarding the stock and the company, and you will decide what to pick.

Scenario:

It’s January 2019, and you have $2,500 to invest in a stock of your choosing. Over the next few months, you will have to make many decisions: do I sell my stock? Do I invest more money? Do I hold? Will you get lucky and choose the best-case scenario? Or will you make a mistake, and lose hundreds?

Option A

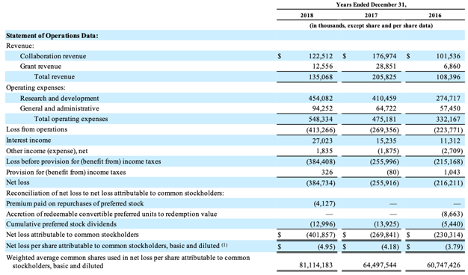

A pharmaceutical company that just had its IPO is currently trading shares for $16.96 and does not offer a dividend. You have $2,500 to invest, which would give you 147.4 shares of this stock. After doing research into this company, you realize that this company has the potential to make an impact on the medical industry for the better. The pharmaceutical company was founded in the United States only about a decade ago and is working to develop treatments for cancer and other diseases. You don’t fully understand the science behind the company’s work, but after reviewing the 2018 annual report, you’re convinced they know what they’re doing. You review the 2018 annual report below and decide to make your final decision.

Option B

You’re looking to expand your portfolio and you’ve watched this company’s stock rise consistently since 2014. The entertainment company is currently trading at around $337/share, (which does not offer a dividend) which means if you invest, you will have 7.42 shares. You’re concerned that there are too few shares to make a strong impact on your portfolio, but if you had invested a couple of years ago you could have easily doubled your money.

You’ve already invested over $75,000 in your 401(k), $25,000 in your Roth IRA, and have $10,000 in other shares in an investment account which you’ve been trading here and there. The extra $2,500 came from a recent Christmas bonus, and you’re determined to make this bonus money work for you. Best case scenario? You hold onto this stock as it steadily increases, turning your $2,500 into a strong asset. Worst case scenario? This stock slowly decreases its value and your Christmas bonus loses its value over the next several years.

Make your choice: (Click on link of your choice)

Option A

Option B