Updated January 15, 2025

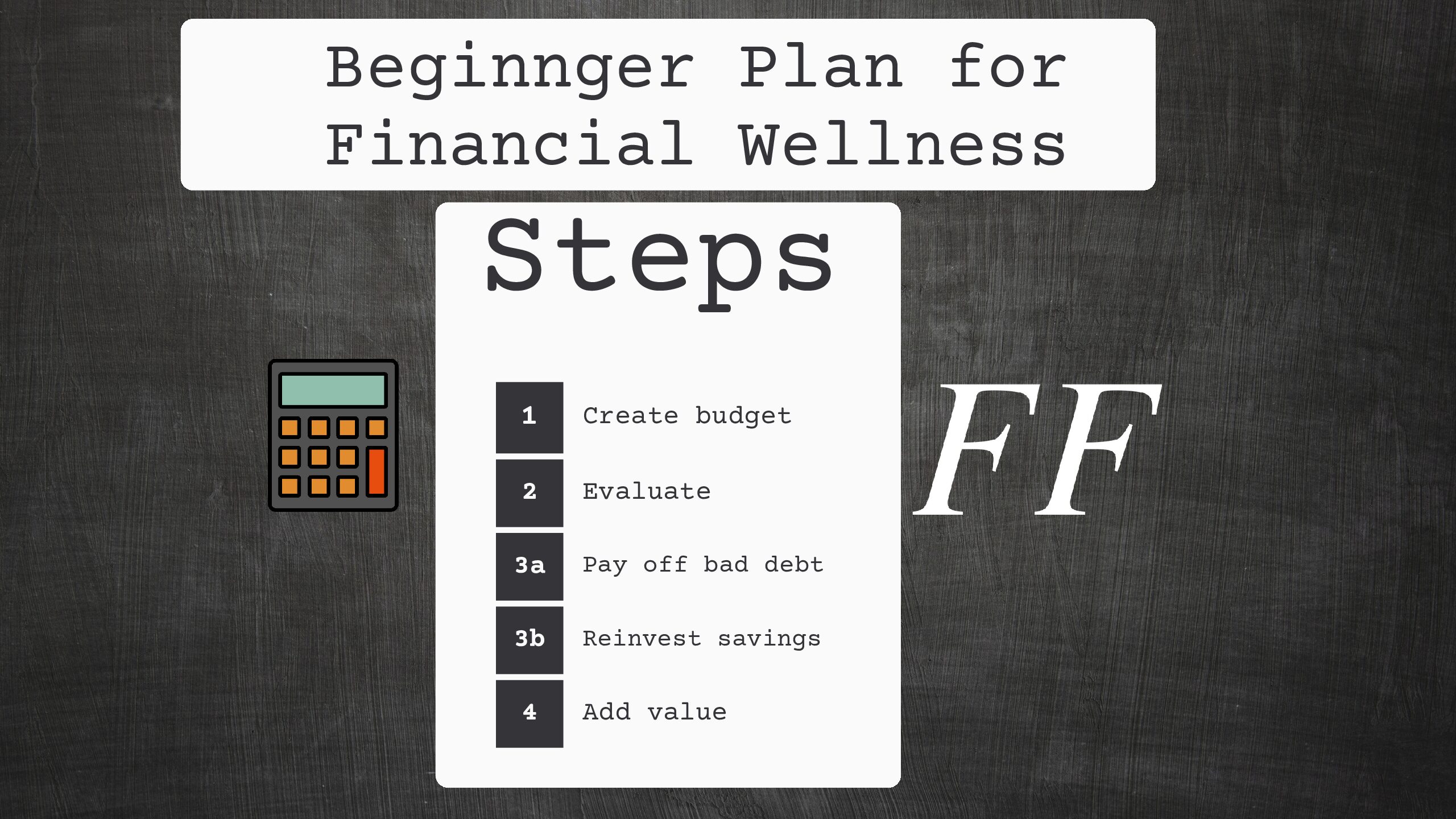

There are a million ways to spend your money. But only a few plans will help you build wealth and financial security. This plan is for those who don’t have a budget or those who do have a budget and need to take that next step.

Step 1 – Understand Your Finances – Create a Budget

Your first step is to understand your finances and create a budget. How much are you spending on rent or your mortgage? How much are you spending on your car payments? What are monthly necessities? What is your net monthly income?

We start there. Once you’ve documented your necessities, find out how much you spend on non-essentials. What are your streaming subscription costs? How much do you spend on eating out? What’s your overall entertainment budget?

Now how much are you making after taxes? (Don’t worry, we’ll work on taxes soon enough).

These three elements are essential to start.

If you need help with creating a budget, you can use this simple budget template here.

After building your budget, go to the next step

Step 2 – Evaluate

You must evaluate your spending. Now that you have identified your costs, see what needs to be changed. Is your car payment essential? Is that specific car you are driving essential? What spending can be curbed? This is an essential part. If you can find an average amount of money to save, you can reinvest this money elsewhere, and save more than just what spending you’ve eliminated/reduced.

Here are some tips:

- Eliminate one or more TV subscription services

- Curb spending on luxury clothes

- Reduce spending on eating out

- Reduce spending on entertainment activities: movies, concerts, etc.

- Avoid upgrading your car if unnecessary

You don’t have to do this all at once. Start small for a lifestyle change. Eat out 3-5 times a week? Change that to 1-2 times. If you have Netflix, Hulu, Disney+, Paramount+, and a TV cable subscription, find 1 or 2 favorite subscriptions, and eliminate the others that you rarely use. Before you know it, you’ve saved $200 (or more) a month! Let’s turn that into a yearly savings of $2400. Remember this number for the next step!

This is also a good time to evaluate your preparedness for emergencies. If there were a health problem with you or your family, are you prepared? If you lose your job, how long can you go without your paycheck?

Step 3a – Pay off some debts

After you evaluate your spending, and curb extra expenses, it’s time to start paying off debt. This step is difficult because you won’t see any immediate returns. However, bad consumer debt such as credit cards and car loans can be costly. Continuing to make purchases on your credit card means you are likely paying a premium for every purchase you make! You’ll have to evaluate your debt to see what is important. If you have no debt (outside of a mortgage), skip to the next step!

You can find our debt calculator here to help you through this step.

If you do have debt, evaluate how long until this debt is paid off. If you have a credit card bill that can be paid off quickly, do it first! Let’s say you have $2000 in credit card debt, and you were paying $25/month already. That can be paid off in 9-10 months (assuming you’ve saved $200) even with interest. You’ve now saved $225/month in less than a year! We can still do more to turn that number into a larger number.

Step 3b – Reinvest!

We’re not talking about stocks yet. That can come later, and there is a lot to understand, especially regarding fees and tax implications. For now, we’re going to talk about retirement.

We all know saving for retirement is vital, and many will roll their eyes at this step. But let’s talk about why it can help you today, and not just when you retire decades from now! Your 401(k) contributions are tax deductible!* This means you save for your future, and you decrease your tax bill for next year. Every dollar you put into your retirement account (assuming 401(k)) is deducted from your income for that year. This means you’re saving by curbing your spending today, and you’ll save for your retirement, all while saving on taxes for next year!

This is a great time to evaluate your health coverage. Did you know that HSA contributions are also tax deductible? If you’re able to increase spending in HSA (from previous savings) you can be prepared for medical bills, and save money in taxes next year.

*Don’t have a 401(k) at your job? Ask your manager/HR rep. If your company doesn’t offer 401(k) you can set up a free IRA Roth with companies such as Fidelity, Charles Schwab, or J.P. Morgan. Ask your local bank as well for Roth IRA options. You can find more information on how to prioritize your investments here.

Step 4 – Repeat, Add Value

Once you’ve completed all the steps, you should consider taking it up a notch. DON’T BACKTRACK. If you’ve saved $250 on frivolous spending and credit cards, it does not mean it’s time to get a new car. Instead, think about how you can pay off all your debt (student loans, cars, other credit cards, etc.) and have this effect snowball on you. Add more money to your 401(k) until you’re maxed out. Maybe it’s time to start thinking about stocks, ETFs, mutual funds, etc (be sure to get educated on tax implications first). This may seem obvious, but often when people get out of small bad debt like a credit card, they see room in their budget to upgrade. Maybe that $20k car turns into a $35k car, and your car payment doubles! Then you’ve wasted your progress and need to start over.

Start thinking big: How can I save even more? Is my tax bill still too high?

Consider these tips:

- Use your savings to pay off larger debts

- Max 401k/Roth (once you can afford to)

- AVOID – using freed finances to upgrade unnecessarily – do you really need that new car or iPhone?

- Learn more tax tips

- Start to get education on stocks/ETFs/mutual funds

- Be aware of get-rich-quick schemes!

- Be aware of trendy stocks and tips!

**Please be sure to do your research, talk with your employers about all your options, and discuss changes with your family before making major financial decisions.

Putting It All Together

Step 1 – Budget and learn where your money is going

Step 2 – Evaluate where you can save money, and start curbing bad spending

Step 3 – Use your savings from Step 2 to pay off debt (and stop getting new debt)

Once you’ve paid off bad debt, start reallocating your savings. Add money to your 401(k) or other savings accounts that can benefit you now and in retirement

Step 4 – Repeat and don’t backtrack! Save more money, and reinvest your savings to build compound interest.

Example

Emma is two years out of college and she wants to save for a down payment for her new house. She brings home $3100/month after taxes and benefits, but never seems to be able to catch up.

Step 1 – Emma builds a budget and realizes she’s spending on average $2650/month. She also is spending regularly on her credit card, while keeping a rolling balance.

Step 2 – Emma realizes she is spending $150 on TV subscriptions, even though she only watches Hulu. Since she graduated college, she’s spent over $100 every month at Forever 21 on new clothes and accessories. She also eats out 5 days a week, but still buys groceries for her apartment, though much of the food goes bad. Her total food budget is over $800/month for just her.

After evaluating her budget, Emma decides to cut down to Hulu and Netflix, cutting her subscription costs to $25/month, and limit herself to $35/month on clothes. She is only going to eat out twice a week, and plans to budget $600/month for food. Her total savings is $390/month.

Step 3 – Emma has two credit card bills totaling $3,500, and pays her minimum payment of $50 on each card. She decides she is going to put her $390 savings each month towards the credit card bill, plus the extra $100/month she was already paying. She should have her credit cards paid off in about nine months.

After Emma pays off her credit cards in nine months, she now has nearly $500 back in her budget. She decides to put an extra $250 of that savings into her 401(k) every month.

Step 4 – Emma does her taxes and realizes that after she starts adding more money into her 401(k) she is getting more money back than ever before. She also got a pay raise and is now making $3,250/month (even with her additional 401(k) savings). She saves $400/month in a high interest savings account, and after one year takes the money out to invest into a 6-month CD, at 4.0% interest. At the end of the six months, Emma has enough money for her down payment for her new home.

After just about two years, Emma was able to turn around her spending habits, save money on debt, save up for a downpayment for a new home, while having money left over to invest for her retirement.

2 thoughts on “Beginner Plan for Financial Wellness”