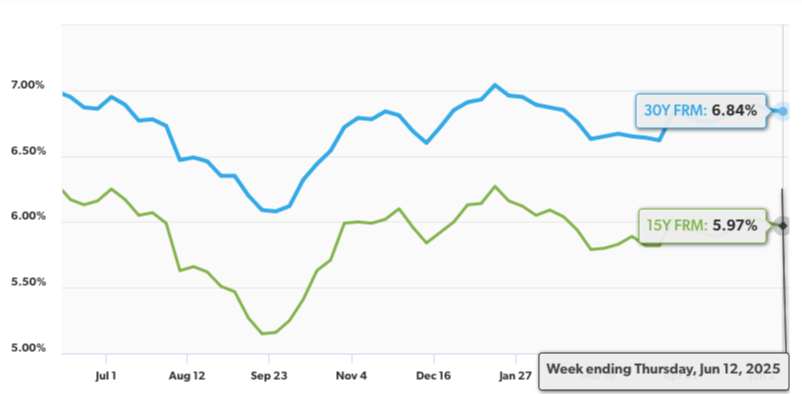

FreddieMac released U.S. weekly averages for mortgages today to a 6.84% for a 30-year mortgage and 5.97% for a 15-year mortgage. 30-year mortgage rates dropped only 0.01% week-over-week. Much needed relief has yet come to home buyers, especially since the summer is heating up.

Home Sales

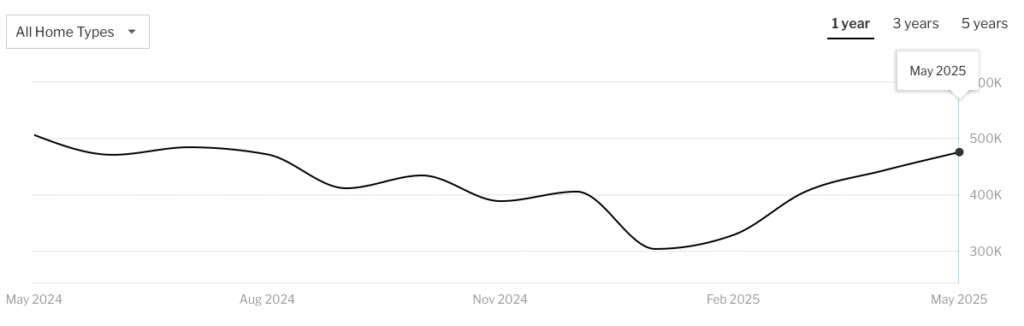

Home sales have been slowly increasing since the beginning of the year, but not as quickly as previous years. May and June are usually peak months for home sales over the last few years, and so far according to Redfin, sales have yet to hit 500k for the May.

Sales are down from May of 2024

We saw the housing market spike to over 700k sales in June of 2021, and each year the peak has dropped lower and lower. Of course, during this time prices have continued to climb. June 2024 saw a peak in median sale prices at $442,541, while May of 2025 saw prices nearing record highs of $441,526.

Mortgage Rates

Mortgage rates saw a 20-year high of 7.79% in November of 2023. During this time inflation in the U.S. was sky-high. Since then, we have seen a steady cooling of inflation and mortgage rates. When the Federal Reserve droped rates last year we saw a strong recovery in mortgage rates falling to a 1-year low of 6.08% for a 30-year mortgage.

However, the Federal Reserve, and specifically Fed Chair Jerome Powell, has said that concerns of inflation are still on the radar. President Trump’s tariffs are at the top of the mind for the Fed, and until there is calm in inflation, and the number drops closer to 2.0% for an extended period, the Fed will continue to hold steady on the current rates.

Home buyers may need to wait a few more months to see rates drop, but while the home buying season is heating up, we may see higher prices and steady interest rates. If you’re looking to get a home, make sure that you have your budget and debt in order. You can find more resources for your home buying experience here at Freedom Finances.

About the Author

Bradley Valentin

Administrator

Bradley, owner and creator of Freedom Finances and Freedom Frontiers Media, has a Master's degree in Business Administration and a Bachelor's of Science in Finance. He is dedicated to helping others learn and build their financial well-being and their careers. Bradley is a business owner of two businesses and is also about to release his first novel, Bright Moon.

1 thought on “Mortgage Rates Barely Drop – Down to 6.84%”