After a few scary weeks, and a terrible two days on the market in April, the stock market seems to be having a strong comeback. Inflation is trending in the right direction, and Americans are feeling better about the economy.

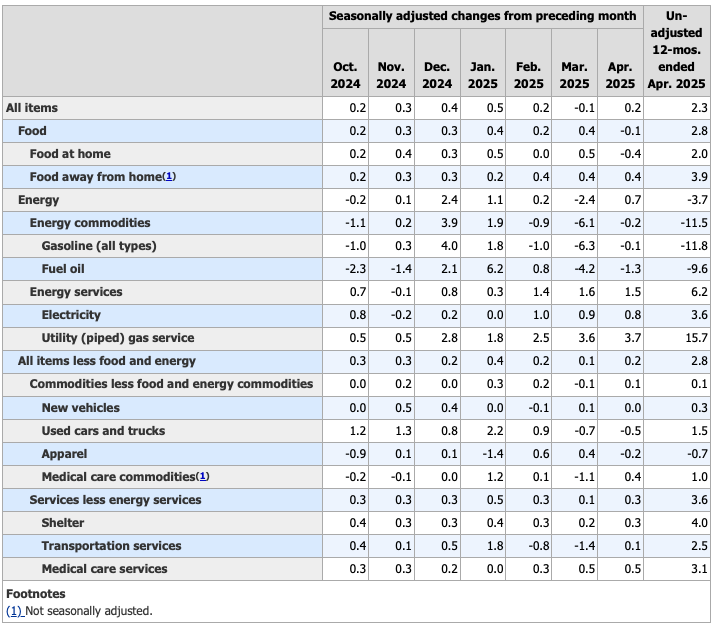

CPI Inflation – 0.2% in April, Down for 12-Months

The U.S. Bureau of Labor Statistics released is Consumer Price Index Summary this morning to a 0.2% inflation for April. March saw inflation slow to -0.1%, down from 0.2 in February. A month to month 0.3% increase seems scary at first glance, but April 2025 was actually down from April 2024. The 12-month inflation rate is 2.3%, down from 2.4% just a month ago. While inflation was up for the month, this is definitely great news for the economy.

Gasoline continues to see negative inflation, as does food. These two heavily impact consumers, and seeing good news back-to-back months have led consumers to positivity.

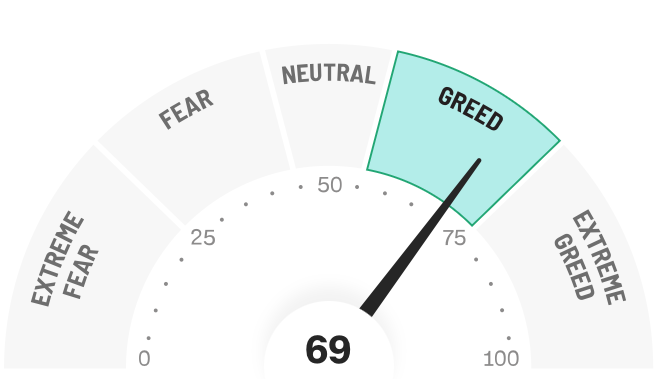

Fear and Greed Index Moves to Greed

The fead and greed index has made a massive change. As the stock market continues to see positive results (nearly eliminating losses from April), consumers and investors are feeling more positive.

Just a month ago, people were operating at extreme fear, a level of 19 (even hitting 3 in April!). Today, the index sits at a level of greed, which indicates people are looking at the market and economy as extremely strong. The economy is growing (even with a negative GDP), and prices are heading in the right direction. While many are still cautious regarding trade and tariffs, most see the direction of the economy heading in the right way.

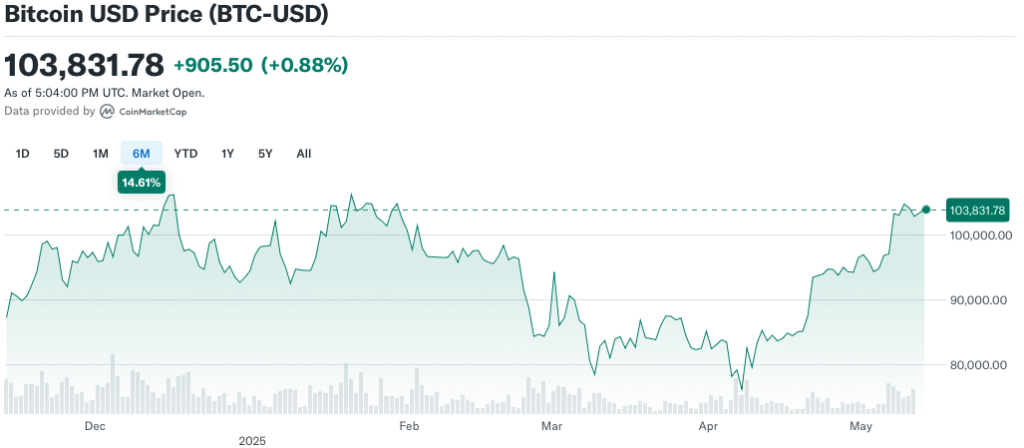

Bitcoin is Looking Strong Again

For those investors of the highly volatile cryptocurrency, Bitcoin is having quite the comeback. The last six months has been a roller coaster for investors, as a rough March and April had losses that are nearly wiped out.

Currently, Bitcoin sits at $103.8k, which is way up from $76 just a couple of weeks ago. After the stock market struggled, Bitcoin followed suit. Bitcoins record high price is just over $105k, and the price will likely continue to grow.

Check out our video review of the finance news for Tuesday below!