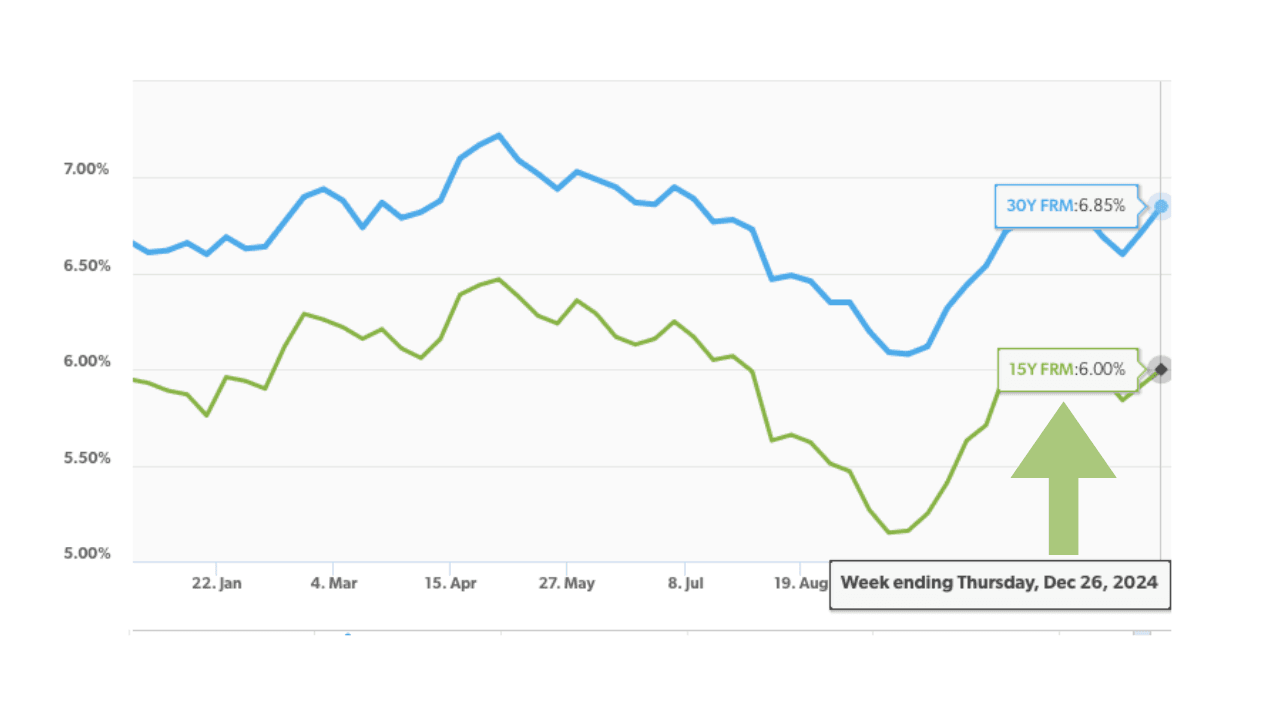

30-year mortgage rates are up to 6.85%, the highest since July 11th. 15-year mortgage rates hit 6%, though on November 27th, rates were even higher for those mortgages at 6.10%. Mortgage rates ending the year so high, tops of a confusing 2024.

2024 Has Been a Difficult Year for Those Looking to Purchase Homes

While rates never hit as high as the 7.79% we saw in 2023, purchasing a home has been difficult for many in 2024. In June, the U.S. set a record-high home purchase price of nearly $450,000. At that time mortgage rates were between 7.03% and 6.86%. The median sale price of a home currently sits at $429,971, a 5.4% increase year-over-year

Median home prices hit a record high in June, 2024

Home sales have dropped drastically over the past few years, currently at 383,863. While this number is up 4.9% year-over-year, it is down drastically since June 2021, when home sales were over 700,000. Demand at the time skyrocketed prices, but ever since demand has slowed, prices have continued to increase, even if at a lower pace.

Should I Wait?

Waiting for the best mortgage rates and best home prices is a catch-22. On the one hand, you might be able to wait a few months, or even a year or two, and catch amazing mortgage rates like in 2018-2020. However, while you do that, prices will likely go up. They may not skyrocket like they have in the last few years, but historically, home prices trend upwards. While there are bubbles like in 2008-2010, mortgage prices rarely fall in the long-term. This means that while you are waiting for mortgage rates to fall, you will see home prices increase.

However, it is important to understand that mortgage rates make a massive impact on monthly mortgage payments. Someone who purchased a home for $500,000 in 2020 may be paying less than someone who purchases a home for $300,000 today because of mortgage rates. Instead of waiting for optimal home prices and mortgage rates, wait for two things: First, you should be able to afford your monthly mortgage, regardless of current or future mortgage rates. If your monthly mortgage is $3,000 with a 6.5% mortgage rate, and you know you might be able to get it down to $2,250 in two years when rates go down, do not purchase the home unless you can afford that $3,000 right now. Second, make sure you have a strong down payment, especially if home prices are elevated. Most homes will increase in value, but if there is a slow-down, you want to make sure that you do not owe more on your home than its overall value. Putting a strong down payment towards your purchase will help you build equity in your home, and bring your overall monthly costs down.

What Should We Expect in 2025?

While 2024 was a difficult year to gauge, 2025 looks to be one of continued recovery. 2024 saw lower interest rates and lower inflation than the previous two preceding years. However, the job market was far from strong, and interest rates continued to fluctuate. Federal Reserve Chair Jerome Powell stated that he expects 2025 to be a year of caution, as inflation bumped up at the end of 2024. He currently projects two interest rate drops, but nothing is set in stone yet. With three consecutive interest rate drops from the Federal Reserve, and two more projected for 2025, one would hope that the new year brings lower interest rates. However, as Freddie Mac states, the current housing market “remains plagued by an overwhelming supply of homes.” If demand continues to outpace supply, prices may slip up even more, while mortgage rates remain unstable. In the meantime, do your best to build a strong budget for yourself, and work towards affording the monthly costs that you need to buy your dream home.